The NEW Bank Case Study

Introduction

This case study introduces a local bank called NEW Bank, which is located in North Wales. Due to the recent political changes associated with banking sector NEW Bank has been asked to re-assess its existing system with a view to developing a new Information Management System for the efficient running of the Bank. Directors of the company have no confidence in the running of the current IT System since it is unreliable and utilises old technology and so needs to be upgraded.

Project

Since the CEO has just appointed a new Finance Director she has decided to invite Management Consultants to assist the users and IT department in the bank to review the current system with a view to upgrading and replacing it. She has been instructed by the board that;

- every option should be explored

- the system must be reliable

- meet the requirements of a modern 21st century Bank

- all areas of the operation should be catered for

- the system must be capable of lasting for at least 5years

- the capital budget with full justification for this project has to be sanctioned by the board before work commences

- Only a minimum of money will be available in subsequent years to this end any savings in the present system should be identified

- The new system should be useable within 12 months of the start date

Guidance:

Briefing notes will be provided to members of the team which are intended to enable the student to role play and provide the necessary input to the project. Since each member of the team will have different roles, which may have conflicting elements, it is essential that only appropriate information is passed to the relevant members within the team.

- Retail Manager

- Investment Manager

- IT Manager

- Consultant

- Supplier

Team Work

In this assignment, you are to develop, present and defend an IT project plan based on the NEW Bank. You may make assumptions about the information you are given, but these must be clearly justified and documented.

Project teams are needed to undertake this work in line with the above criteria. Teams should be made up of 5 students, it is not necessary to have 5 people in each group but more than 5 is discouraged due to the balance of work required. Each member of the team will adopt a specific role and both the teams and roles within them have to be agreed by the lecturers before progressing.

The fundamental criterion for success in this assignment is to convince the CEO and the Finance Director that your project meets the required quality of the organisational structure and strategy of the IT project with supporting evidence of the portfolio.

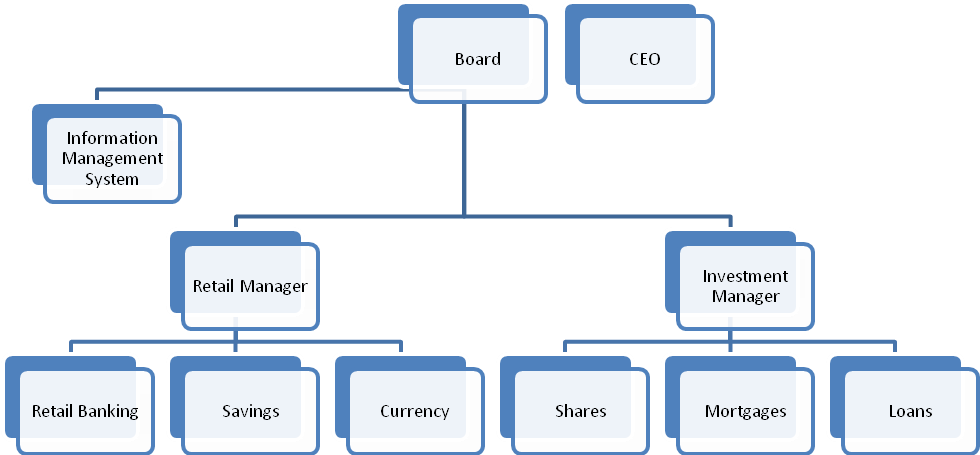

The basis for the project organisation will be based on the following diagram.

Figure 1 – NEW Bank Organizational Chart

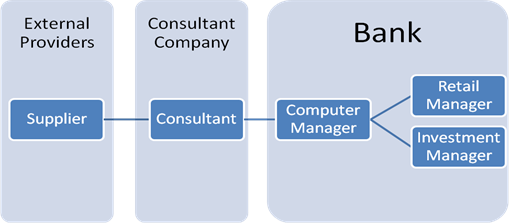

Figure 2 Roles within the Bank

This assignment covers all learning outcomes specified in the module specification.

- Demonstrate and justify a professional approach to IT practice, including adhering to the codes and guidelines of professional bodies within the industry.

- Evaluate the professional, ethical, social and legal implications associated with IT project management.

- Critically evaluate possible solutions to a problem and select the best approach, both technically and commercially, demonstrating a critical understanding of the importance of the decision-making process in IT management.

- Evaluate and apply the essential tools and techniques of IT project management.

- Demonstrate an in depth understanding of the issues involved in planning and controlling an IT project.

Key skills for employability:

- Written, oral and media communication skills

- Leadership, team working and networking skills

- Opportunity, creativity and problem solving skills

- Information technology skills and digital literacy

- Information management skills

- Research skills

- Intercultural and sustainability skills

- Career management skills

- Learning to learn (managing personal and professional development, self-management)

- Numeracy

Part 1:

The brief description about the department and business activities include marketing, sales, hiring employees, customer service, accounting and budgeting. The marketing activity is done to popularize the bank among masses so that they could prefer their services for investment and banking facilities. The sales activity and customer service ensures that the banking services are delivered to the customers in the best possible way keeping records of daily transactions. The hiring of employees is actually done with the purpose to place the best person for the job. The accounting and budgeting further helps in running the business in the most profitable manner.

Part2:

The main objectives of the department for the new IT system include the followings.

- Developing new mobile application so that the customers could download the application from the play store and avail various benefits and facilities of the banking system.

- Creating a reliable system that explores all the possible options.

- Meeting the requirements of the modern 21st Century banking system.

- Developing an updated system that could be capable of performing latest banking tasks for next five years.

Part 3:

The business case objectives that are estimated to be fulfilled include the followings.

- Creating cost benefit analysis so that the right estimation of cost and the estimated outcome could be made and compared so as to access the profitability of the business.

- Estimating payback period in which the benefits and gains from the technology could pay back desired level of returns on investment.

- The accounting rate of return should fulfil the requirements of the business process.

Part 4:

The project organization and scope include the followings.

- S- System boundary: System boundary should be developed such that it supports different tasks of the business.

- C-Constraints: Constraints should be set well in advance so that the right outcome can be estimated from the new IT applications.

- O-Objectives: Objectives of the business after the application of new IT system should be set such that they could be defined, concentrated on and finally evaluated to estimate the level of outcome and gains achieved by the business.

- P-Permission: Permission to initiate the new IT application for different business purposes should be taken into consideration.

- E-End product: End product of the IT application would include improved customer service, better business administration and effective control over business process.

Part 5:

The role definition and objectives of the retail management after new IT application in “NEW BANK” includes the following.

- The retail management in newly IT updated New Bank will result in improving the capability of the banking system in offering variety of banking facilities through online system.

- The investment, saving and other added features made available online through web portal would help the customer save a lot of effort in travelling to bank premises. Also they will be in a condition to review the various facilities and select the most appropriate for them.

- The retail management will improve with the quick and easy facility available for different banking system made available to the visitors of bank premises.

Part 6:

The work or task breakdown along with time and resource estimation can be depicted as follows.

| Work Breakdown | Time estimation | Resource estimation |

| Initiate project | 10 days | $5,000 |

| Making facilities available through web portal | 30 days | $ 25,000 |

| Developing technical and software requirements | 10 days | $10,000 |

| Adding new banking facilities for the customers | 20 days | $5,000 |

| Simplifying the whole banking system | 10 days | $10,000 |

| Testing software | 10 days | $5,000 |

| Improving employee productivity through training and development programs | 30 days | $10,000 |

| Total | 120 days | $ 70,000 |

Part 7:

The Gantt chart and resource assignment matrix can be stated as follows.

- Gantt chart:

- Resource Assignment Matrix:

| Work Breakdown | Investment Manager | Computer Manager | Consultant | Supplier | Retail Manager |

| Initiate project | N | C | S | A | |

| Making facilities available through web portal | S | N | G | C | R |

| Developing technical and software requirements | N | C | A | S | G |

| Adding new banking facilities for the customers | N | S | A | C | R |

| Simplifying the whole banking system | S | N | C | A | R |

| Testing software | A | N | S | G | R |

| Improving employee productivity through training and development programs | G | N | C | A | S |

R= Responsible, S= Support Required, C= Must Be Consulted, N= Must be Notified, A= Approval Required, G= Gate reviewer

Part 8:

The project monitoring and control structure include monitoring the existing business process and applying changes to deploy latest IT engagement. In addition development of tolerance level so that the required target and goals are accomplished. This process can be achieved through following format.

| Tracking Project Status Checklist | ||||

| Checklist | Yes | No | N/A | Remarks |

| Initiate project | ||||

| Making facilities available through web portal | ||||

| Developing technical and software requirements | ||||

| Adding new banking facilities for the customers | ||||

| Simplifying the whole banking system | ||||

| Testing software | ||||

| Improving employee productivity through training and development programs | ||||

Part 9:

The quality management in the new IT development can be achieved through quality control and assurance. That is the continuous process improvement is tried to be achieved through placement of new products and service in the banking sector. The new services deployed could support the business process by easing the system service application. Also the assured output can be achieved through deployment of the effective IT process and management. The quality controls can be made by the reporting of the updates and upgrades made in the IT project. This would help the various human resources stay aware of the changes initiated and estimate the level of gains and profits that can be gained from it.

Part 10:

The risk management in the NEW BANK during and after the deployment of IT application could be done through identification of priorities that could be accessed at different point of time. The risk assessment can be done by identifying various risks that are possible to affect the business process during and after IT application. Furthermore the assessment of the each risk should be done and prioritized so that different course of action could be applied.

Part 11:

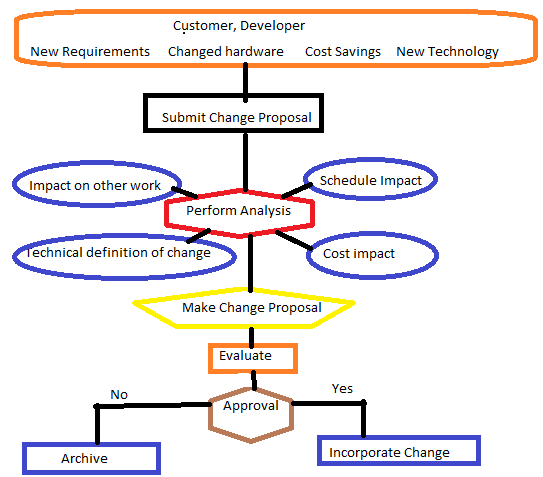

Change control and configuration management could be done as follows.

Part 12:

The tendering information would also be revealed under which the new project will be partially being outsourced so as to achieve cost effectiveness. This will include framing the web portal so that the business process could be initiated with new IT related updates. The tender will therefore attract the relevant applicants from around the world so that the best of the knowledge and service could be hired for the NEW BANK system operations which need to be upgraded.

Part 13:

The strategy within the department will be to review the existing process and compare up with other trend in the banking sector. Also the efforts would be made to prioritise the factors that needs utter attention so that the banking service can be improved and the customers could be offered with variety of IT services. The application of Agile approach will be done under with the initial planning will be done to set up strategy that would help in devising the new age IT system for NEW BANK. This will be followed by analysis and evaluation of existing system and identification of the new age IT system that needs to be deployed.

Furthermore the costing line of codes will be used in the following format.

| Analysis codes/ Labels | Data Type | Costs |

| Initiate project | Mandatory | $5,000 |

| Making facilities available through web portal | Mandatory | $ 25,000 |

| Developing technical and software requirements | Mandatory | $10,000 |

| Adding new banking facilities for the customers | Mandatory | $5,000 |

| Simplifying the whole banking system | Mandatory | $10,000 |

| Testing software | Mandatory | $5,000 |

| Improving employee productivity through training and development programs | Mandatory | $10,000 |

The risk log for this can be stated below.

| Risk Number | Risk | How Likely is it? | How serious is it? | What we can do about it? |

| 1 | Delay in Initiating project | H | M | Efforts to initiate project in time. |

| 2 | Lesser facilities available through web portal | H | M | Allocating different facilities for the web portal |

| 3 | Non development of technical and software requirements | H | H | Making available different software applications |

| 4 | Not adding new banking facilities for the customers | M | M | Reviewing customer requirements and adding new facilities |

| 5 | Completing the whole banking system | M | L | Changing the system such that it becomes customer friendly. |

| 6 | Incapacity to test software | L | L | Making test of software compulsory |

| 7 | Inefficiency to improve employee productivity through training and development programs | M | M | Offering benefits for successful completion of training program. |

The main motive is developing new mobile application so that the customers could download the application from the play store and avail various benefits and facilities of the banking system. Also creating a reliable system that explores all the possible options. In addition the efforts will be towards meeting the requirements of the modern 21st Century banking system. The developing of an updated system is finally tried to be applied that could be capable of performing latest banking tasks for next five years.

Bibliography

Khan, A.A., Zaman, N. & Dawood, M.U.Z., 2008. Online Banking Transaction System. Journal of Information and Communication Technology, 2(2), pp.90-100.

Schwabe, K., 2014. Information technology project management. (Seventh Edition). Cenage Learning.

Shu, W. & Strassmann, P.A., 2005. Does information technology provide banks with profit? Information and Management, pp.781-87.

Sonteya, T. & Seymour, L., 2012. Towards an understanding of the business process analyst: An analysis of competencies. Journal of Information Technology Education Research, 11(1), pp.43-63.

Stoica, M., Roach, W. & Price, D., 2012. Wireless Business and the impact on Firm performance: The strategic move to adopt a new technology. International Journal of Management and Information Systems, 16(1), pp.45-54.

West, D., 2012. Issues in technology innovation: How mobile devices are transforming healthcare. Insidepolitics.org, pp.1-14.

Whitman, M. & Mattford, H., 2014. Hand-on information security lab manual. 4th ed. Boston, Massachusetts: Thomson Course Technology.

Wu, F., Yeniyurt, S., Kim, D. & Cavusgil, S.T., 2006. The impact of information technology on supply chain capabilities and firm performance: A resource-based view. Industrial Marketing Management, 35, pp.493-504.

Leave an answer