Report

1.0 Introduction

This prototype for making the reinventing money in Nigeria is in conjunction with the IMF as the new generations are living in a cashless society. Therefore, the brief has been given to evaluate the mission for re-inventing money through 2050 year. All the functional requirements are going to be discussed to manage the thinking ability for a better opportunity towards customers’ needs. The provided solution is also going to add to deliver better solutions.

2.0 Brief

The Nigerian country is dependent on a heavily cash-oriented life. The financial scenario in Nigeria is completely dependent upon the cashless ability in phrases of tremendous human and herbal sources in Nigeria. However, the complicated situation is that has been seen by the observers of the Nigerian financial system itself in its financial mess given through the IMF stability in the recent financial ability.

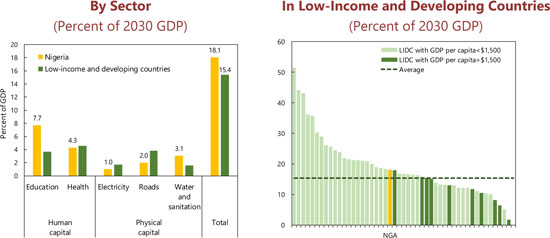

Figure 1: Nigerian staff report for IMF

(Source: https://www.elibrary.imf.net)

Recommendations are on the way to correctly enforce the cashless coverage in different to inspire the Nigerian enterprise proprietors to be a part of it (Garba, Adamu & Augie, 2021). If important measures aren’t installed and the essential stakeholders to the coverage carried alongside with concerns can also have an effect on the customers, the cashless coverage will adversely have an effect on various failures. Nigeria owes the 2 establishments to make the spending as great as N3. The CBN has delivered a new coverage on cash-based total transactions which stipulates a cashless society.

3.0 Discussion

3.1 Functional requirements

Customers nowadays are more prone to selecting online transactions rather than involving in cash-based transactions. Nigeria isn’t neglected in this fashion because cashless coverage is the present-day innovation through the new generation in Nigeria.

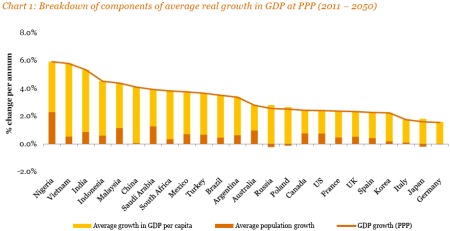

Figure 2: Nigerian future success

(Source: https://qz.net)

Amongst its numerous efforts it is to reform the economic system of the Nigerian. Other quarters have recognized infrastructure and the purposeful fame of the Nigerian economic group as throughout developing new thinking ability in resolving the hindering factors (Adeyemo, et al. 2020). It will additionally proffer a way to the approaching demanding situations that various companies and customers and other stakeholders groups will face in a recent time effective cashless society.

3.2 Opportunity

Finally, it will approach the right position of coverage makers at the survival of customers’ needs. This coverage may be done due to lots of problems affecting the Nigerian economic system; from attempting to test cash laundry and illicit activity, inflation, a fee of maintaining a financial system predominantly coins-based, or simply right vintage alternate, that’s one element it truly is usually steady in life (Ibukun & Cynthia, 2020). The Nigerian financial system is simply too closely cash-orientated in transactions of products and services. This isn’t in line with the worldwide fashion, thinking about Nigeria’s ambition to be among the pinnacle 20 economies of the sector via means of the year 2020.

3.3 Design thinking

Define problems

Major issues that have been seen nowadays in maintaining the Cashless transactions that are envisaged to impede the implementation of the coverage are illiteracy and another one is cyber fraud. The trouble of record is also suggested for the other problems, if the playing cards are adaptable to preserve statistics of banking for the customer’s needs and shopping for patterns, a scenario may arise.

Development of provided Approaches

Therefore, based on the findings of this descriptive study approach, a few tips made are: the authorities ought to undertake a specific approach to educate the non-literate Nigerians approximately about the cashless economy, and this particular approach tried to rectify the issues by the help of a through description provided in this paragraph. A greater framework ought to be laboured out to offer cyber protection in Nigeria (Jemilohun, 2019). When authorities officers and proponents speak of the profits of a cashless economy it is dealt with customers’ needs. The government can accomplish that as though it’s far from heaven-packaged, tailored to remedy the various issues of Nigeria, without negative consequences. Good as it is able to be made to look; various transaction solutions will come at a few costs. The customers should apply various technology-based ways, like, credit card transfers, phones pay, etc. to make the solutions to the problems. Therefore the new ideas should be approached to evaluate balance in the customers’ needs and their future access.

4.0 Conclusion

Here in this solution prototype, there is the brief given for managing the IMF to build a cashless society for Nigerians. It has been produced for making the customer’s segments more presentable throughout their transactions. Stakeholders’ application has been gathered here with the proper problems findings and its given solution. It has been sup[porting the ideal solution in the section of design thinking capacity.

Reference list

Journals

Adeyemo, K. A., Isiavwe, D. T., Adetula, D. T., Olusanmi, O., & Owolabi, F. (2020). Mandatory adoption of the Central Bank of Nigeria’s cashless and e-payment policy: implications for bank customers. Banks and Bank Systems, 15(2), 243-253. Retrieved from: http://eprints.covenantuniversity.edu.ng/15110/1/Mandatory_adoption_of_the_Central_Bank_of_Nigeria.pdf [Retrieved on: 15.2.22]

Garba, N., Adamu, A., & Augie, A. I. (2021). Energy Policy in Nigeria: Prospects and Challenges. International Journal of Energy and Power Engineering, 15(11), 388-393. Retrieved from: https://www.researchgate.net/profile/Abdulrahaman-Idris-Augie/publication/356694746_Energy_Policy_in_Nigeria_Prospects_and_Challenges/links/61a7cb3a29948f41dbb97dbb/Energy-Policy-in-Nigeria-Prospects-and-Challenges.pdf [Retrieved on: 14.2.22]

Ibukun, F. O., & Cynthia, A. C. (2020). A Cashless Policy and Economic Development in Nigeria. Randwick International of Social Science Journal, 1(2), 204-210. Retrieved from: http://www.randwickresearch.com/index.php/rissj/article/download/45/35 [Retrieved on: 16.2.22]

Jemilohun, B. O. (2019). Legislating Against Cybersquatting in Nigeria: Moving Beyond Penal Law Into Protective and Compensational Remedies. JL Pol’y & Globalization, 84, 85. Retrieved from: http://repository.elizadeuniversity.edu.ng/bitstream/20.500.12398/680/1/Legislating%20Against%20Cybersquatting%20in%20Nigeria_Moving%20Beyond%20Penal%20Law%20into%20Protective%20and%20Compensational%20Remedies.pdf [Retrieved on: 14.2.22]

Leave an answer